SURVEY:

We conducted a survey to get a better understanding of the current consumer behavior and social mood. The link to our survey is as follows:

http://www.surveymonkey.com/s.aspx?sm=KKjobToRhP8L_2fpAMz1r3sA_3d_3d

By clicking this link, you can see the various questions that were asked. A total of 97 individuals completed the survey and gave us a general understanding of the current consumer behavior. Although demographics were not assessed, college students are assumed because the survey was performed at Washington State University. The survey results are as follows:

1) How are you currently spending your extra cash?

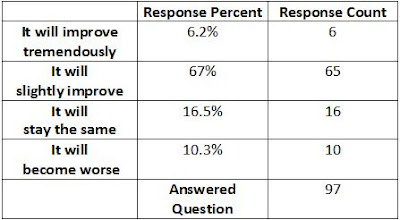

2) How do you feel the current economic conditions will change over the next two years?

2) How do you feel the current economic conditions will change over the next two years? 3) Rank the level of importance when purchasing a new product.

3) Rank the level of importance when purchasing a new product. 4) What is your household yearly income?

4) What is your household yearly income? 5) When buying a new product, what factor is the most important basis of your purchase?

5) When buying a new product, what factor is the most important basis of your purchase? 6) What color are you most likely to purchase during the Fall? (Choose Two)

6) What color are you most likely to purchase during the Fall? (Choose Two) Based on that data, it is apparent that there are very similar trends among the consumers. For example, 50% of the survees are most concerned about price when purchasing a product. When ranking the level of importance, price and quality were most frequently ranked as 'Extremely Important'. Quality was ranked at 49.4% (39 people) and Price was ranked at 55.1% (43 people). To our surprise, 71% (49 people) ranked ec0-friendly as 'Doesn't Matter Much'. With the rising concern of global warming and other environment-conscious movements, we assumed eco-friendly would be an important factor. Eco-friendly products often come with a higher price tag and when money is scarce, it may be put on the back burner in the eye of the consumer. We were happy to see that 67% of the survees have a positive attitude about the economy and expect a slight improval within the next two years. Our data may be biased due to the small demographic and number of people that were surveyed, however, we feel that these trends are a good basis to understanding the entire population.

Based on that data, it is apparent that there are very similar trends among the consumers. For example, 50% of the survees are most concerned about price when purchasing a product. When ranking the level of importance, price and quality were most frequently ranked as 'Extremely Important'. Quality was ranked at 49.4% (39 people) and Price was ranked at 55.1% (43 people). To our surprise, 71% (49 people) ranked ec0-friendly as 'Doesn't Matter Much'. With the rising concern of global warming and other environment-conscious movements, we assumed eco-friendly would be an important factor. Eco-friendly products often come with a higher price tag and when money is scarce, it may be put on the back burner in the eye of the consumer. We were happy to see that 67% of the survees have a positive attitude about the economy and expect a slight improval within the next two years. Our data may be biased due to the small demographic and number of people that were surveyed, however, we feel that these trends are a good basis to understanding the entire population.B. Consumer Psychographics

- What Consumers Are Buying:

(Image courtsey of http://www.marketoracle.co.uk/)

As depicted on the graph above, unemployment rates have drastically increased due to a lack of hiring and job layoffs as an effect of the faltering economy beginning around 2008. The peak in April 2009 was 9% of the population. Therefore, people will spend less and save more because they are making less money to support themselves. In effect, the economy suffers more because consumers are not making as many purchases. As seen from the survey we conducted earlier, our target market (college female students) focuses on buying basic needs rather than apparel. In the future, if the social mood of consumers increases, consumers will spend more causing businesses to prosper more and in return, will offer more jobs for people. This can decrease the unemployment rates and help consumers gain more money to spend on things other than essential needs.

- Cash for Clunkers:

Cash for clunkers was a program initiated by the U.S. government in order to stimulate auto sales and promote a healthier "green" environment. Cash for clunkers lasted approximately a month during the summer of 2009 and gave consumers the option to trade in their old cars or trucks for a more fuel efficient vechile. The dealerships were offering $3500 to $4500 for old "clunkers" in order to get the poor emission vehicles off the road. This bill not only stimulated auto sales, but also promoted a step towards a green environment.

Cash for clunkers was a success because it took 690,114 older vehicles off the roads, replacing them with more fuel efficient vehicles. This cash value was an incentive for consumers to purchase new vehicles. The high demand created more jobs and stimulated the economy during a hopeless time of the recession. Toyota, Honda, General Motors and Ford were the main vehicle retailers that had the highest number of transactions.

Although the cash for clunkers had many positive influences, it has has also developed a false interpretation of the current economic circumstances. During the summer months and into September, there was a peak in the consumer spending, but that spending has unfortunately been slowed tremendously as we approach the winter seasons.

(Image courtesy of http://www.sbcimpact.net/2009/08/06/consumer-debt-sucking-the-life-out-of-ministry/)

(Image courtesy of http://www.sbcimpact.net/2009/08/06/consumer-debt-sucking-the-life-out-of-ministry/)(Cash for Clunkers, courtesty of http://autocareinsurance.com/articles/2009/08/27/cash-for-clunkers-facts-and-figures/)

C. Consumer Behavior

According to a Consumer Behavior survey conducted by the Pew Research Center in 2009, the number of items that Americans consider as 'necessities' has increased dramatically within the past decade. A Clinical Psyhologist by the name of Pauline Wallin, Ph.D. also found that consumers base what they consider 'necessities' and what they consider 'luxuries' by their lifestyle and other group pressure influences. For further information refer to http://www.rkma.com/2009ConsumerBehaviorSAMPLE.pdf or http://www.pewresearch.org/.

This is a chart that the Pew Research Center formed based on what consumers consider to be necessities.

"First, you want stuff because other people seem to have it. It becomes a necessity only after you've come to depend on it. We have become a lot less self-sufficient about things and rely more on machines and technology to do stuff for us. The cellphone is the perfect example of how a gadge infiltrates the culture. When cellphones first came out, they were a novelty and there weren't that many uses for it. Who would you call? The more an item penetrates the culture, the more applications it has and the more we rely on it."-Dr. Pauline Wallin, Clinical Psychologist

"First, you want stuff because other people seem to have it. It becomes a necessity only after you've come to depend on it. We have become a lot less self-sufficient about things and rely more on machines and technology to do stuff for us. The cellphone is the perfect example of how a gadge infiltrates the culture. When cellphones first came out, they were a novelty and there weren't that many uses for it. Who would you call? The more an item penetrates the culture, the more applications it has and the more we rely on it."-Dr. Pauline Wallin, Clinical Psychologist - Concerns about global warming/sustainability:

Global warming is a great concern for many individuals as the consequences are becoming more relevent. Greenhouse gases that we have become extremely dependent upon, such has carbon dioxide, are being trapped around our earth causing a "blanket". If we maintain our current lifestyles and carbon dioxide usuage, we will not being only dealing with heat rise but many other consequential catastrophes such has drought and flooding. Sea levels may also rise and the ice caps are at risk for melting as well as the spread of desert land. (Courtsey of http://www.environmentcity.org.uk/article.asp?ParentID=4&ArticleID=65

- Hidden Current: 2012 uncertainty about "end of world":

With the current uncertainties concerning the "end of the world" on December 21, 2012, many people worldwide are unsure whether to believe these allocations. There are several predicitions from the Mayan calender to other biblical sources that support these claims. Worries about world catastraphes are on the rise, including global warming and other consequential factors(drought, famine, floods, hurricanes, tsunamis, earthquakes, volcanic eruptions, disease, terrorist attacks, wars and human suffering). Following, are two surveys that were conducted by an outside source in order to gain a better perspective on how individuals are currently feeling about these circumstances. It is apparent that a high majorty of individuals are skeptical or unsure what to think during these uncertain times.

(Chart courtesy of http://www.endoftheworld2012.net/2012sitepoll.htm)

(Chart courtesy of http://www.endoftheworld2012.net/2012sitepoll.htm) (Chart courtsey of http://www.endoftheworld2012.net/2012sitepoll.htm)

(Chart courtsey of http://www.endoftheworld2012.net/2012sitepoll.htm)D. Relating Current Consumer Behavior to Similar Times in History

- Recession of the Early 1990s:

After a short-lived economic crisis in 1987 America rebounded slightly before falling back into a recession with the savings and loans crisis. (Mason, David L. (2001). From Building and Loans to Bail-Outs: A History of the American Savings and Loan Industry, 1831-1989. Ph.D dissertation, Ohio State University, 2001.)

The result was $124.6 billion loss for the U.S. government and the financial wellbeing of millions of Americans. (Mayer, Martin (1992). The Greatest Ever Bank Robbery : The Collapse of the Savings and Loan Industry. New York: C. Scribner's Sons.)

By 1990, the beginning of the Gulf War and resulting spike in oil prices increased inflation. Several years of high unemployment rates, government budgetary deficits and low consumer confidence affected the U.S. population until late 1992, while banks continued to suffer well into the mid-1990's. ("Savings and Loan Industry, US". EH.Net Encyclopedia, edited by Robert Whaples. June 10, 2003", "Lessons of the Eighties: What Does the Evidence Show?" (PDF). FDIC. September 18, 1996.)

- Relation the 1990s Recession to Economic Recession of the late 2000s:

We are currently experiencing the same lack of consumer confidence as seen in the early 1990s. Similar to the Gulf War spiking oil prices, American has seen the War on Terror cause an enormous spike in oil prices. "How Should We Measure Consumer Confidence?",

"consumer confidence is now down to the same level as when American went into

recession in the early 1990s" (Dominitiz and Manski, 2004).

The economy in the early 1990s suffered the consequences of the 1987 stock market crisis and the savings and loans scandal, putting Americans in debt and adding to the unemployment rates. (Dominitiz and Manski, 2004).

In 2008, America experienced a similar financial crisis which increased unemployment rates and put Americans into debt, also causing several banks such as Washington Mutual and well-established companies, especially in the U.S. auto industry to go bankrupt.

(Image courtesy http://blurblawg.typepad.com/.a/6a00e54f87 1a9c88330120a5197bda970b-500wi)

In the above graph, you can see that the number of failed banks and trusts is much lower in the current recession that in the recession of the early 1990's yet we are only in the second year. In addition the banks that have failed are generally much larger in size than those that failed in the savings and loans crisis as can be seen in the graph below.

(Art courtesy http://www.lemetropolecafe.com/img2009/Wellman/ Wellman0809_files/image003.gif)

This current recession, similar to the one in the early 1990s, was in part caused by the reckless and sustainable lending practices resulting from the deregulation and securitization of real estate mortgages in the U.S.

"Then, as now, the government created tazpayer-funded enterprise to absorb the fallout from bad real-estate investments." (Keehner, Jonathan. " Originally published Saturday, October 11, 2008 at 12:00 AM Comments (0) E-mail article Print view Wall Street bailout harkens back to S&L crisis." Seattle Times 11 Oct 2008.: Real Estate. Print.)

Taxpayers not only found themselves carrying the burden of the economy they also found themselves out of work.As of November 2009, the U.S. unemployment rate reached 10.2 percent.("Employment Report: 190K Jobs Lost, 10.2% Unemployment Rate." CalculatedRisk , Finance and Economics 11 June 2009: n. pag. Web. 8 Nov 2009.

We are currently experiencing the same effects in reduced consumer buying as we have seen in the early 1990s but on a larger scale. We can also see this in the social mood of the eras. For example, the social mood in the early 1990s was negative as seen in Grunge music and minimalism in fashion. The social mood today is negative as well as seen in the unwillingness to spend and uncertainty of the future. Due to low consumer buying and increased saving due to financial hardships, the economy has suffered. It is also interesting to note that retail stores have suffered as well, so much so that holiday season hiring has shrunk by almost half since 2007. (https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhFXMrxQx0-3cO3LHgL8D7Lh2G_2-ai0VCOiBwMrHuv9wgH1PEtkAlhLbmIb3bVCS5EkGDQGYHykebGVdqBoBv6BraPHjegFWG6KtqfE_8Trzrdj1PZdlGIsA7ptZS4P9DUviQrMp2f07I/s1600-h/RetailHiringOct.jpg)

No comments:

Post a Comment